Management-Buy-In (MBI) /

Management-Buy-Out (MBO)

"Whether for reasons of continuity within the company or for want of a strategic purchaser, the involvement of the old or a new management requires a solution which is both fiscally and economically viable and which will guarantee the survival of the company in the long term."

(Dr. Jürgen Steuer, Executive Director U.C.A. AG)

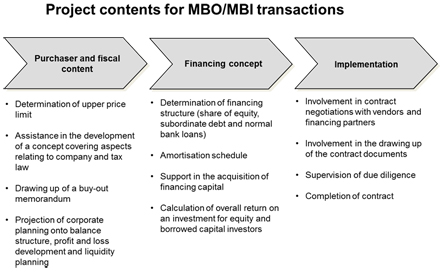

The advisory services for buy-out structuring are directed primarily towards the existing management (MBO) or executives approaching the company from the outside (MBI). In many cases these are situations in which an optimal structuring of the transaction from a financial and fiscal point of view plays a decisive role because of the limited financial power of the purchaser. Buy-out structuring can accordingly also be used in the case of other transactions (purchase, sale) as well as in the re-structuring of a corporate constellation.

Depending on the situation, U.C.A. works on various sides: as adviser during execution for the vendor of the company shares or to accompany the management in the structuring and search for financial investors. In any case a significantly increased value for the client will be achieved:

-

Assessment and examination of the transaction with regard to opportunities and risks as well as the feasibility and profitability of the proposal at a very early stage.

-

Observance of time-critical aspects and thus piloting of the transactions in accordance with the project plan until completion.

-

Conclusion of the contract with the best achievable conditions on the financial market.

- Development of a purchase, tax and financing concept in close agreement with the appropriate professional bodies.