News

U.C.A. AG invests in AndCompany GmbH

> IR-News lesen

A group of investors advised by Rigeto Unternehmerkapital GmbH ("Rigeto") has founded the Unternehmerholding AndCompany GmbH. Under the umbrella of AndCompany, a network of complementary companies is being created, which offer high-quality software development as well as digital and IT services with a focus on the DACH region. In a first step, AndCompany has completely taken over ion2S GmbH based in Darmstadt.

In recent years, ion2s has grown dynamically and has risen among the 50 largest digital manufactures in Germany. With about 80 employees, highly complex digitalization solutions, web portals, eShops and Saas applications are developed for large companies as well as customers of the upper middle class. From the development of customized solutions including integration into the existing application architecture (ERP, CRM etc.) to open source web development with CMS solutions (TYPO3 etc.), store and headless solutions (Contentful, Spryker), the entire technological spectrum is covered.

AndCompany enables successful IT entrepreneurs to work closely with complementary sister companies. A complete range of services can be offered to joint customers: from the digitalization of the end customer interface to the intelligent use of each company's data treasure trove and the development of scalable and high-performance services. The IT contractors belonging to AndCompany are provided with central services such as personnel recruitment and development. The group affiliation enables the companies to offer their specialized know-how to the customers of sister companies ("Land and Expand"). In addition, AndCompany offers a highly attractive transition and succession arrangement or a lucrative exit channel for the selling entrepreneurs.

U.C.A. AG participates with approx. 1% in the Search Fund of Vonzeo Capital

> IR-News lesen

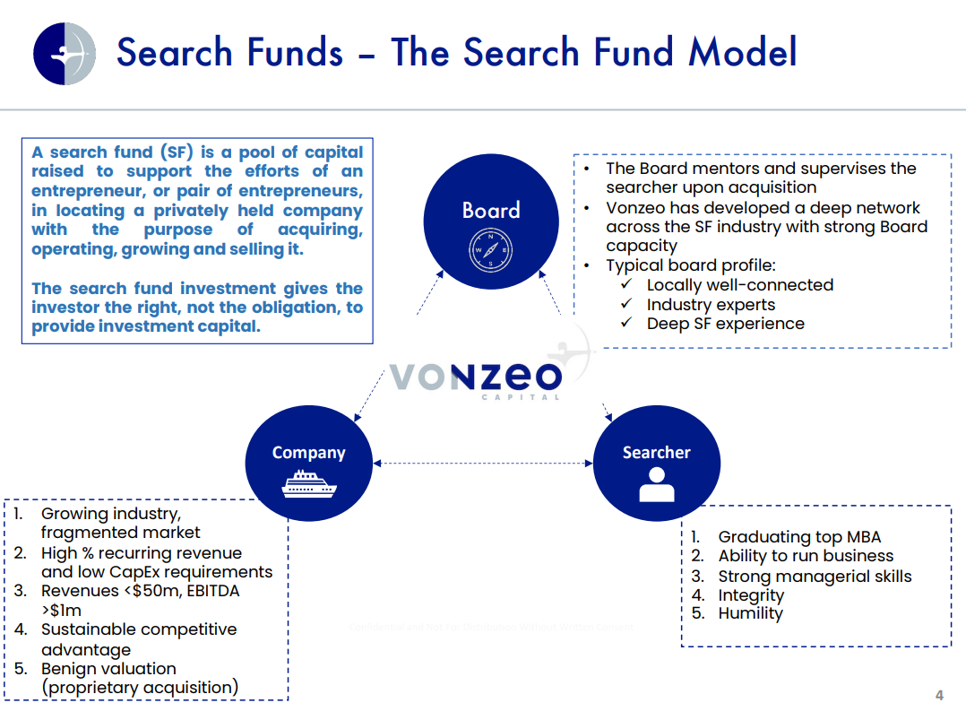

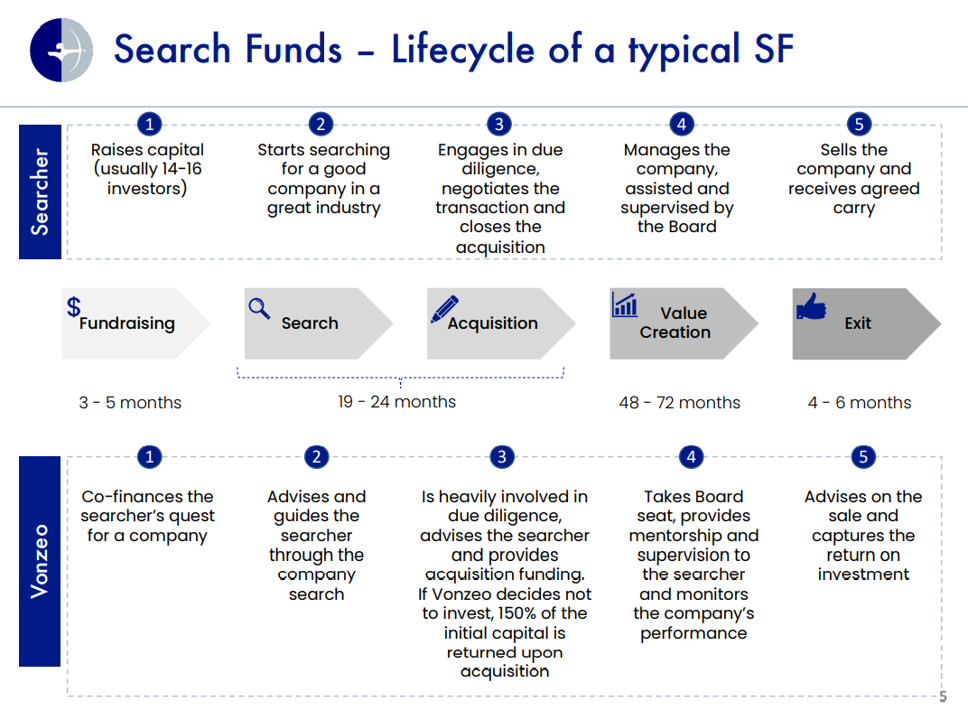

Founded in 2017 with offices in Barcelona and Vancouver, Vonzeo Capital is a dedicated investor in search funds across Europe, Latin America and North America. It was the first institutional investor of its kind outside the US.

Search funds acquire minority interests in micro / small cap businesses (revenue $1m) and drive growth with the support of ambitious operators and strong boards. This has led to historic and persistent returns of >30% IRR since 1984.

Vonzeo seeks to invest in simple operations with strong recurring revenue models, often within a growing but niche industry. Typically, search funds provide a solution to succession issues and following a proprietary search, acquire good companies in great industries at benign valuations.

Fund I ($25m commitments, 2017) has funded 55 searchers and closed on 16 acquisitions (a total of c30 is expected by 2023). c$14m invested to date across searches / acquisitions. The portfolio has significant exposure (c76%) to the healthcare, services, software and technology sectors - see pages 9 and 10 for additional info.

Fund II target commitments: $50-60m. Closed on $35m from Fund I LPs, friends and family. GP commitment: at least 5%. 23 searchers funded, 1 acquisition completed. Expected to allocate to c80 searches and make c50 acquisitions.

Team is led by Jan Simon and Kristoff Puelinckx, both have >20 years experience at leading international investment banks and management consultancy firms – JS: Salomon Brothers, Merrill Lynch and Goldman Sachs – KP: Delta Partners Group (co-founder), Ernst & Young, Oliver Wyman and Tennium (co-founder).

Deep connections across the global MBA ecosystem provides outstanding access to next generation talent.

Exceptional Advisory Board and Senior Advisors from within the search fund community – key value-add includes leadership on the boards of portfolio companies and enhancing Vonzeo’s status as a ‘first port of call’ for searchers and acquisitions.

U.C.A. AG has acquired a < 2% stake in inopla GmbH, Düsseldorf

> Read news

Founded in 2008, inopla GmbH offers cloud telephone systems and automatic call distribution (ACD) systems for German medium-sized businesses. The inopla cloud telephone system is highly scalable and enables location and device-independent use, intelligent call control, best-in-class integration of Microsoft Teams and numerous interfaces to e.g. CRM systems such as Zoho and MS Dynamics. Cloud ACD enables efficient intra-team call distribution in call and service centers. inopla's products are deeply integrated into customers' processes and enable workflows to be designed more efficiently and cost-effectively.

With an active customer base of >2,000 customers, inopla is considered the provider with the most comprehensive functionality and the best price-performance ratio in its customer segment. Revenue and customer base have grown rapidly in recent years. The ongoing "cloudification" of B2B telecommunication is driven by trends towards decentralized working and higher flexibility, cost savings as well as an increasing orientation of companies towards higher customer satisfaction and sustainability.

The company currently employs over 20 people at its two locations in Düsseldorf and Kölln-Reisiek. The two founders have taken a stake in the transaction and will continue the business in the medium term with the aim of establishing a succession plan together with Rigeto. In the course of this, extensive investments will be made in the further growth of the company. The focus will be on the expansion of the sales and marketing organization, the further development of the product portfolio and the broadening of the organization. In doing so, Rigeto will contribute its many years of experience in expanding successful, established B2B business models.

aovo achieves a significant leap in earnings with an annual net profit of €481k

> Read news

Hanover, 21 June 2018 – The Supervisory Board of aovo Touristik AG has adopted and approved the company's audited annual accounts during the board meeting which took place today. Net profit for the year after tax rose to €481,000 (previous year -€324,000). At the end of 2017, aovo Touristik AG once again showed a positive equity value of approximately €53,000 (previous year -€428,000) due to the fact that earnings were considerably higher than expected.

The company's net profit is expected to be published in July 2018 and can be found on the company's website at www.aovo.de.

About aovo Touristik AG:

aovo Touristik AG was founded in the year 2000 and has become one of Germany's leading niche travel operators. The company has sold more than 850,000 travel packages to more than 2 million travellers to date. The publicly listed company focuses on developing package and modular solutions for adventure holidays and short breaks that cater to different areas of interest such as cultural trips, events, spa breaks and culinary experiences. aovo Touristik focuses on providing city breaks within Germany and neighbouring European countries.

For further information on aovo Touristik AG, please visit

> www.aovo.de.

Final Results 31 December 2017 Following the Proposal for the Appropriation of Profits Pursuant to the HGB (German Commercial Code)

> Read news

In 2017, U.C.A. AG generated income from investments of €697k (after offsetting relevant expenses) (previous year €583k). Financial earnings from interest income and expenses, in conjunction with other income and expenses from securities held for investments, total €485k (previous year €287k). In addition, revenue and other operating income totalled €66k (previous year €100). However, total operating costs stood at €618k (previous year €615k).

After factoring in a tax bill of €12k (previous year €13K), an annual net profit of €618k was achieved (previous year €342k).

U.C.A. Group's liquidity (including liquid stock held for investment, valued at market rates in accordance with commercial law) stands at €8 million (previous year €8.4 million).

The Supervisory Board and the Executive Board propose that the reported net income for the financial year 2017 totalling €886,437.41 should be used as follows:

| a) | To be allocated to participating shareholders through the payment of a dividend of €0.70 per no-par value share, payable on 10 July 2018 | €436,296.70 | |

| b) | Balance to be carried forward (=profit brought forward) | €450,140.71 |

Upon acceptance of the proposal of the Executive Board and the Supervisory Board, the following shall apply to the payment of the dividend: Since the dividend for the 2017 financial year is fully payable from the tax contribution account within the meaning of § 27 of the Corporation Tax Act (not contributions to nominal capital), payment will be made without any deduction for capital gains tax and solidarity surcharge. Dividends are not subject to taxation for German resident shareholders. Tax refunds or tax credit options are not linked to the dividend. In the opinion of the German federal fiscal authorities, a dividend payment reduces the tax acquisition costs of the shares.

U.C.A. AG Has Acquired a 2% Stake in Dermedis GmbH, Munich

> Read news

Dermedis is a leading provider of medical/aesthetic cosmetic treatments and operates in six prime locations across Germany. Dermedis offers a broad range of medical/cosmetic treatments for healthy and beautiful skin. Dermedis GmbH achieves very high levels of customer satisfaction through its use of state-of-the-art treatment techniques and methods and thanks to its highly qualified non-medical practitioners, beauticians and dermatologists. In addition, the company sells leading premium branded cosmetic products through both its brick-and-mortar and online shopping channels.

U.C.A. AG Publishes Preliminary Results on 31/12/2017

> Read news

Before Investments Are Evaluated

Munich (pta) – In 2017, before taking into account any depreciation or appreciation on investments (after offsetting relevant expenses), U.C.A. AG generated income from equity investments of €504k (previous year €583k). Financial earnings from interest income and expenses, in conjunction with other income and expenses from securities held for investments, total €477k (previous year €289k). In addition, revenue and other operating income totalled €75k (previous year €103k). By contrast, total operating costs stood at €619k (previous year €620k).

After factoring in a tax bill of €12k (previous year €13k), an annual net profit of €425k was achieved (previous year €342k).

U.C.A. Group's liquidity (including liquid stock held for investment, valued at market rates in accordance with commercial law) stands at €8 million (previous year €8.4 million).

U.C.A. Group's preliminary operating results are subject to the auditors' report and approval by the Supervisory Board. The final financial and revenue figures for the 2017 financial year are anticipated to be published on 18 May 2018.

Judicial Appointment of Supervisory Board Member

> Read news

At the request of the company's Executive Board, the district court of Munich (registration court) has appointed Achim Gippers Dipl.-Ing., born 23/10/1955, as a member of the Supervisory Board with effect from 13 March 2018.

The judicial appointment of the new member of the Supervisory Board became necessary after the previous member of U.C.A. Group's Supervisory Board, Nico Baader, resigned from his position due to personal reasons.

> News archive

> Information for our shareholders